AI - Digested

What does the AI industry look like right now, why are investors excited, where does the real value lie and what are the outstanding concerns and risks to be overcome?

Welcome to Invigorate's new newsletter - Invigorating Insights. Thanks for reading. As always, comments, thoughts and challenge is welcome! Let us know what you think about this newsletter and our new format.

If you found this interesting, feel free to share it with others who are curious and/or focused on AI.

There’s a lot of buzz around AI right now, from the AI-generated images that have been flooding social media, to articles, opinion pieces and even keynotes speeches celebrating a coming AI revolution. But with all this excitement in the air, it’s worth taking a step back to reflect on AI as a whole, how VCs are actually approaching the topic, and where the real value is likely to be found in the coming years.

AI has made massive strides in the last decade or so - from the rise of machine learning algorithms deploying content and ads to users on Google, Tiktok and Netflix, to the voice recognition and comprehension technology in your phone’s virtual assistant. Significant new innovations, such as the Transformer Natural Language Processing (NLP) model invented at Google, are also being very quickly adopted and innovated upon themselves, thanks to an emerging culture both entrepreneurial (4 of the 8 people named as authors on Google’s transformer paper have started AI companies of their own now) and frequently open-source. But in a sector this fast-moving it has also become increasingly difficult to make value assessments - from understanding where in the tech stack breakout value is most likely to be found, to identifying whether businesses with proprietary models and databases, or super-agile application only businesses are better suited to the long-term market conditions.

So what does the AI industry looks like right now, why are investors excited, where does the real value lie and what are the outstanding concerns and risks to be overcome?

Several deeptech investors and operators got together recently to attempt to answer these questions. Most of the conversation is covered below, however, the main outstanding question remains - how do AI applications and systems build trust and explainability for the users? Something to bear in mind as we dive in.

What makes up AI?

Firstly it's worth breaking down the AI tech stack. As with today’s internet, a lot of value sits behind the consumer-end apps, in the models and infrastructure required to run each application.

The AI tech stack is broadly composed of three different tech layers:

- Applications that integrate AI models into a user-facing product, either running their own model pipelines (“end-to-end apps”) or relying on a third-party API

- Models that power AI products, made available either as proprietary APIs or as open-source checkpoints (which, in turn, require a hosting solution)

- Infrastructure vendors (i.e. cloud platforms and hardware manufacturers) that run training and inference workloads for AI models

Most AI businesses do not own all three parts of this stack, with many businesses focusing on just one or two levels. Andreessen Horowitz has broken down this tech stack for the generative AI market, to demonstrate how services like Github Copilot, OpenAI, and Amazon Web Services all play distinct roles in the AI ecosystem - this framework could be applicable across the broader AI stack as well.

As we deep-dived with fellow investors recently, we concluded that there may be another layer to this stack that provides 'verification', 'explainability' or 'reference checking', most likely to be an independent provider, which is an important part of broader adoption.

But despite the heavy focus on generative AI right now, it is only one strand of many. AI is used in everything from social media algorithms to data security. Some potential applications include:

- Healthcare - to screen patients and reduce waiting times

- Finance - machine learning and algorithmic training to predict the market and automate and optimise decision-making on everything from loan approvals to trades

- Data security - helping predict cyber attacks and locating weaknesses in security systems

- Social media - algorithms managing and organising vast amounts of data

- Automotive - self-driving cars

- Robotics - allowing computers to carry out tasks without pre-programming

- Manufacturing - optimising processes and supply chains and providing quality-control

- E-commerce - product recommendations and chatbots

This list is by no means exhaustive but demonstrates some of the potential use cases for different strands of AI, and can give some sense of the scale of the opportunity to businesses.

What does the AI landscape look like right now?

You can get a sense of the scope of the AI market right now from this market map by CBInsights. This map displays the 100 most promising private AI businesses in the world according to CBInsights criteria, which include R&D activity, market potential, and investor profile.

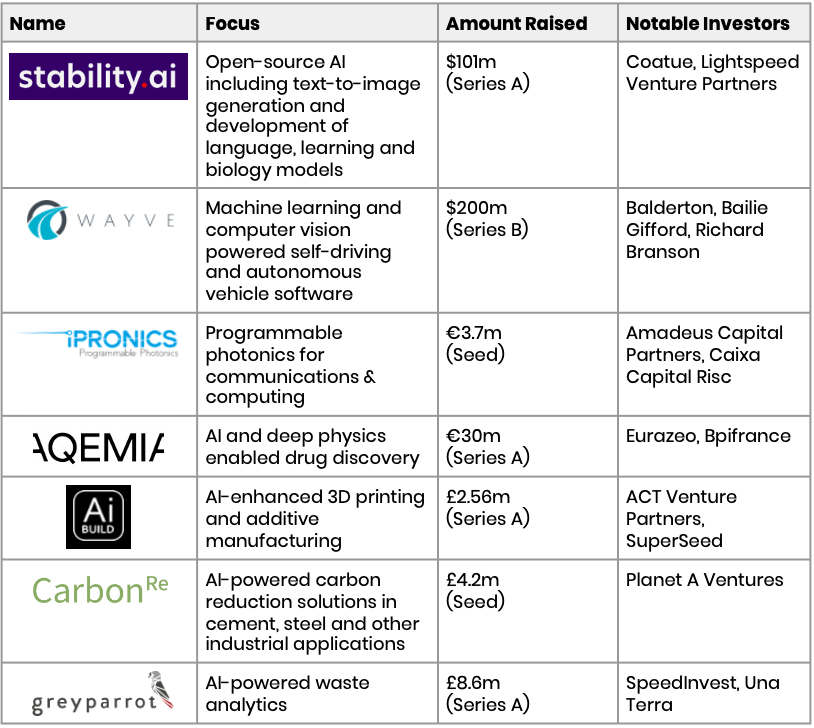

You can also get a sense of the range of promising AI businesses by looking at notable recent funding rounds. We’ve collected a small selection of these rounds here, along with the business’s focus and major investors:

However, looking at industries and individual businesses will only give a fairly incomplete view of where investment is flowing in AI.

There are massive disparities in VC investment, as the graphic below shows, with vertical applications taking home the lion’s share of investor cash ($217.3b in Q2 2022). The other categories still received heavy investment (horizontal platforms raised $67.6b in the same period) but there is a clear investor focus.

AI businesses have seen investment from a range of sources, including both VCs (both sector-specific and agnostic) and corporate investors. The below map charts investors investing in European deeptech, and the stage they each focus on:

You can view a more detailed breakdown of some of the most active UK deeptech investors here, or for Europe here.

What’s changed?

It’s clear big shifts are happening in AI, but why now?

Machine learning and AI have been in use for years now, providing everything from facial recognition software, to grammar advice and video suggestions - so what’s causing this sudden surge in interest and investment?

- Cheaper computing and new techniques have made training algorithms cheaper and more successful, and many developers have opened betas or shifted to open-source, encouraging innovation

- Lower computing costs have made it easier for small players to innovate and compete

- Consumer interest in accessible strands of generative AI has driven adoption

- Stronger government demand (and interest) in AI services and applications

- Talented alumni from tier 1 AI labs are flowing into smaller ventures - increasing competition and innovation

- A surge in innovative new research and advances in topics such as AI cognition - which allows AIs to pick out the important parts of prompt or sentence to use or respond to

- Growing awareness of the potential value the AI sector stands to create

It’s also worth remembering that we already use various AI products in our everyday life - from Siri and Alexa and the rest of the virtual assistants, to Google search algorithms and the technology powering your Netflix suggestions.

Where does the real breakout value sit?

AI holds the potential to revolutionise our society, and may well make a similar impact to the growth of computing, software and the internet.

However, it’s not always easy to predict which sectors, use cases, and businesses will succeed. Google came fairly late to the search engine game, MySpace and MSN were crushed during the rise of Facebook, and Amazon’s internet retail service profits are now dwarfed by those produced by Amazon Web Services (which produced 74% of Amazon’s operating profit in 2021).

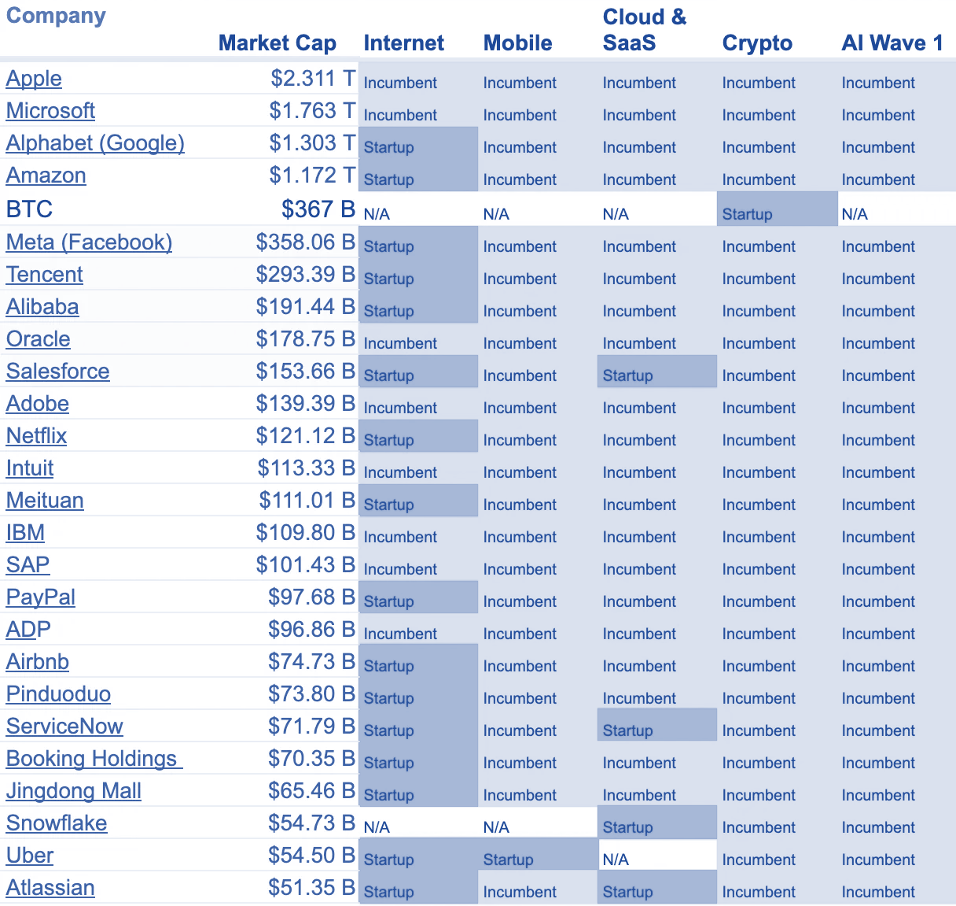

What’s more, as the table below shows, where industries have existing incumbents in a similar or compatible technology, they can go on to dominate markets:

This means that, while there is likely a lot of value to be captured in the infrastructure layer of AI, the difficulty of competing with massive incumbents make it less likely that we will see breakout startup challengers in that area. For example, despite recent innovation, semiconductor and AI chip company Nvidia’s datacenter revenues currently outstrips the combined valuations of its 3 top startup competitors.

Consequently, at the moment it looks like the real breakout value may be found in the models powering AI applications - as proprietary models built on massive datasets possess more innate defensibility than apps built on non-proprietary models. But with the market still developing and the technologies powering AI improving in leaps and bounds, the more agile applications which are able to pick and choose between the cheapest and most advanced models may yet have a distinct advantage.

It’s also important to note that as market leaders emerge, we are likely to see more vertical mergers and partnerships - such as with Microsoft’s recent investment in OpenAI:

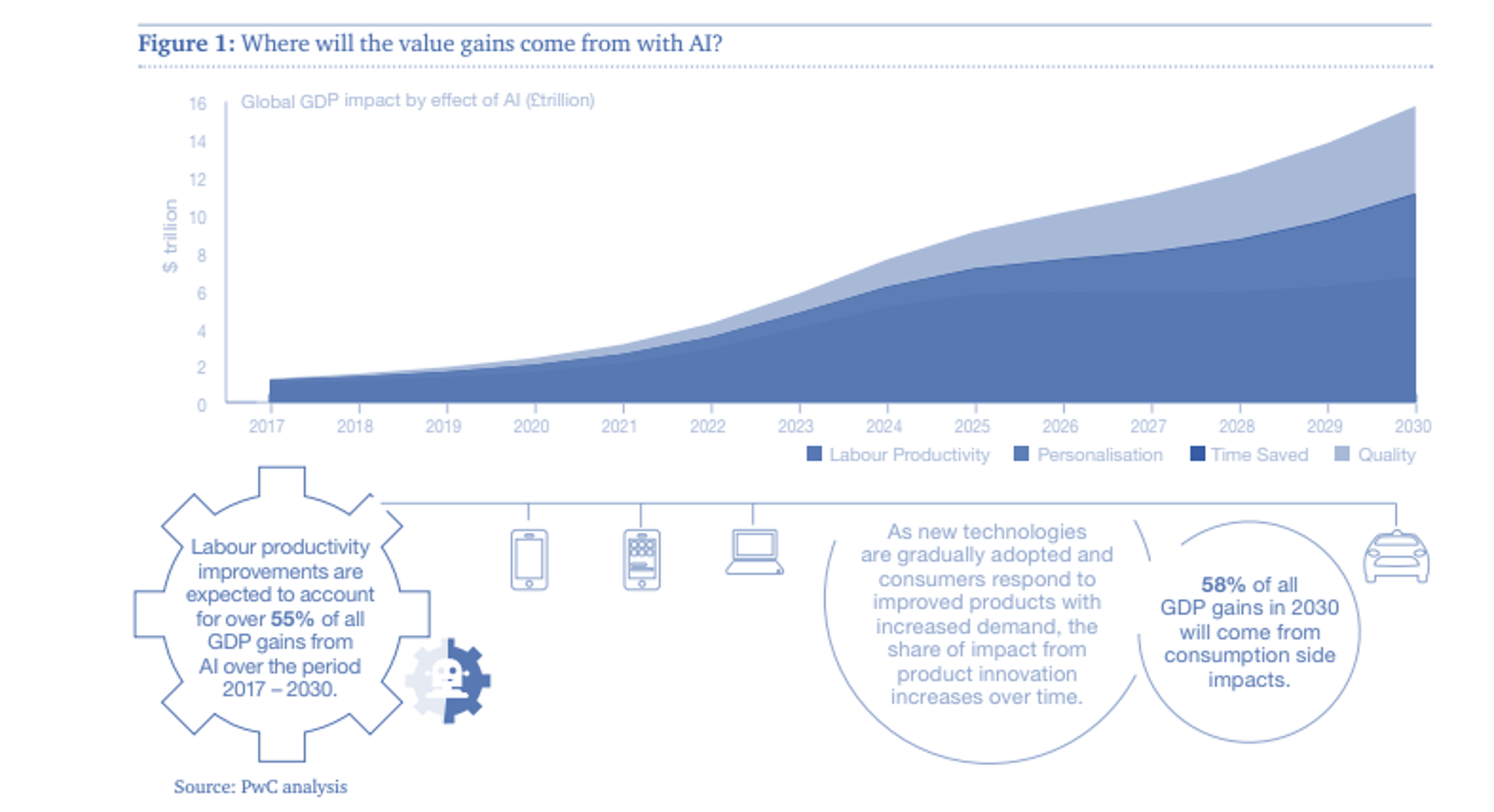

So as AI is adopted, who stands to gain the most? A recent PWC report into the potential of AI predicts that AI will create $6.6 trillion of value in increased productivity in 2030 (and contribute $15.7 trillion to the global economy overall). You can view their breakdown of predicted value creation below:

AI is predicted to cut costs, increase productivity and provide a powerful competitive edge for business in a variety of industries. However, AI also has some serious risks and challenges associated with it.

What challenges does AI (and AI investment) face?

AI has undeniable potential, but as a nascent market, it still faces a great many challenges.

Overhyped software

We have all had fun playing with the latest AI tools on the market, but the leap from fairly accurate tools in a very limited use-case to the sort of content generation many spectators are talking about is massive, and will require significantly more technological progress than the five minutes you might take to rewrite a ChatGPT prompt. Nathan Benaich at Air Street Capital highlights this as something many people run the risk of underestimating:

“The risk I see is that generative AI has become voted as a consensus investment theme in the span of like two weeks or however long. The reality is — even though the progress right now seems like it’s exponential in images, video and text — I think there’s just so many nuances that companies need to solve for when they take these capabilities and build products for many people to use in a workflow.”

There is also concern about what might happen to the market as the hype amongst consumers wears off, with questions about long-term business models and consumer interest. Even amongst the hot AI apps flooding our social media feeds right now, revenue is very limited, and there is not yet much evidence of consumer willingness to pay.

Intellectual property and copyright

With most AI training on massive databases of literature, art and data, questions have begun to be raised about the potential for intellectual property and copyright problems - particularly if an AI were to inadvertently plagiarise its sources beyond the protections of fair use. There are also ongoing concerns about the ownership of anything an AI produces, with the UK and US courts recently ruling on the question of whether to grant patents to an AI, (in addition to growing discussions about the legal liability of individuals and businesses whose AI’s inadvertently perform illegal actions).

Safety and ethics

While AI is making technical strides in many areas, questions about its potential dangers to society could limit its use in certain cases. For example, the San Francisco Police Department recently u-turned on their approval of police robots using lethal force in certain scenarios following significant public pushback - and the deployment of AI in similar situations would be likely to receive similar response. Ultimately, whether it's in a healthcare situation, or in policing and defence, any situation where an AI might potentially harm a human being (inadvertently or by design) will likely be subject to significant legislation and debate. The EU, for example, is currently in the process of bringing the AI Act into law, in an attempt to impose ethics and safety standards across the industry.

There is also increasing concern about how people might choose to use AI. Recent releases of image and text generators have seen large numbers of people successfully foiling safety features to produce pornographic, violent, or otherwise banned content. The models themselves are also at risk of misuse, with new research showing ML models designed to discover new drugs can just as easily be asked to create biochemical weapons.

AI also poses a certain amount of existential risk, with a recent survey to the NLP research community revealing 36% saw a risk of AI causing a nuclear-level catastrophe within the century. There has been a recent uptick in research into AI safety, but this field remains neglected compared to the broader AI industry.

Market timing risk

There is significant market timing risk attached to any emerging technology, and AI is no exception. In the case of AI, this market timing risk is somewhat exacerbated by the complicated tech stack, with some infrastructure and machine learning models providers exposed to market timing risk from AI businesses at different levels of the tech stack as well as from the consumers of the end product. Likewise, AI applications providers require strong models to power their software, and are vulnerable to problems caused by an insufficiently-mature supply chain.

As AI has become a hot investment category, market commentators have also expressed fears of a dot com style bubble, as investors pump money into businesses with dubious technology or no route to profit.

Defensibility

It’s much quicker to build an AI app when using existing AI models, but there are concerns this won’t be defensible in the long run. A16z have discussed concerns about whether the rapidly changing landscape will favour businesses who can cheaply swap providers and models, or those who own their proprietary data.

The journey from academia to industry

In the last 10 years, the number of large-scale AI experiments by academics has dropped from 60% to nearly 0%. This has serious implications for the availability of talent, safety, and AI research focus.

4.3% of the UK’s AI businesses are university spinouts (compared to 0.03% on average). But the high equity share Technology Transfer Offices often negotiate can disadvantage founders - particularly given information sharing problems prevalent at this level of the startup ecosystem. (For more on this, check out our report into some of the challenges facing the deeptech sector as a whole.)

Politics and international tension

Global tensions are increasingly causing supply issues for many businesses - including those developing AI products. Recent American legislation preventing major AI chip supplier Nvidia from selling to Chinese companies and universities has been widely predicted to slow Chinese AI innovation until domestic suppliers can fill that gap, while Russian sanctions preventing the export of rare elements such as neon and helium have restricted the production of semiconductors.

Changing economic and fundraising conditions

AI startups benefitted from the 2021 VC funding boom, but increased competition for capital could slow growth for some businesses now that market conditions have changed:

However, it is worth noting that cash supply remains strong in the early and mid funding stages - suggesting that the market outlook for AI may still be fairly strong. Also, while the sector as a whole shrank in 2022, generative AI bucked the trend, seeing record funding.

So what does the future of AI hold?

Ultimately the success of AI will come down to how well it can tackle and overcome many of the challenges listed above - and on the future decisions of governments, regulatory bodies, and public opinion.

It’s clear AI has the potential to reshape the business ecosystem - and to generate massive amounts of value - but like us, you're probably backing or building where you believe the breakout value will be found.

For more on AI, deeptech, and other frontier technologies changing the scaleup ecosystem (as well as opportunities to get involved, invites to exclusive investor-only events, and insights into the UK venture ecosystem), subscribe to Invigorating Insights.